Advancing digital transformation in financial services

With secure data management and eXplainable AI technology, Rulex assists financial services in their digital transformation journey.

Banks and financial institutions can leverage Rulex Platform to develop data-driven solutions, enhancing day-to-day decision-making, process efficiency, and customer loyalty.

Empowering global finance

Powered by Rulex Platform, global banks and financial organizations have enhanced day-to-day decision-making by implementing solutions for compliance and reporting, lending and credit risk assessment, and customer analysis.

Download our use case e-book to read about some of these success stories.

RULEX

SOLUTIONS

USE CASES

FREE RESOURCES

Rulex Platform

Why Rulex is different

Transparent technology

Compliant processes

With its advanced data governance and encryption, Rulex ensures data integrity, security, and compliance, enabling financial institutions to meet GDPR and industry regulations.

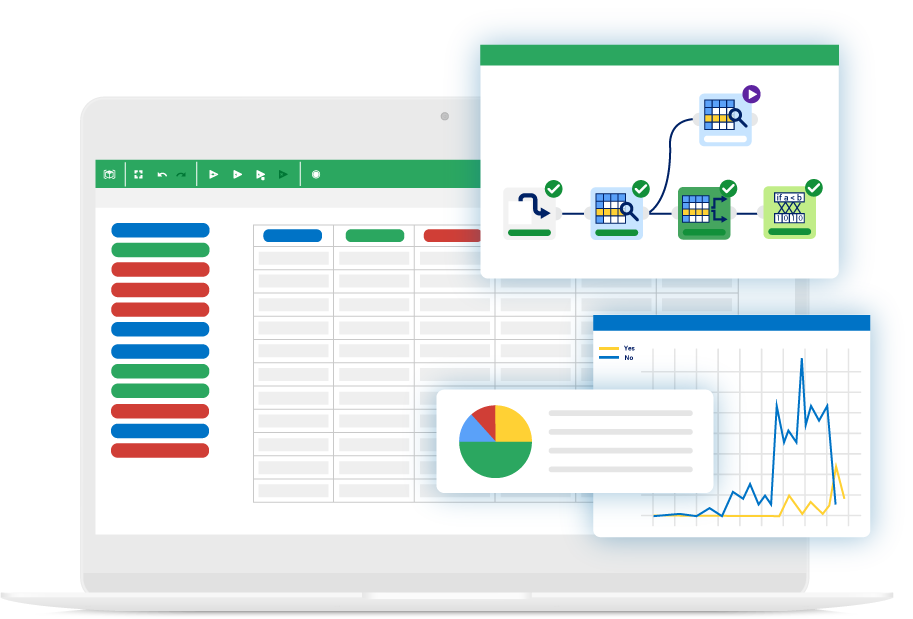

Intuitive software

With a WYSIWYG, drag-and-drop interface, Rulex Platform enables independent control over all aspects of data management in a single environment, empowering business users.

Solutions

What we do for financial services

compliance and reporting

lending and credit risk

Customer analysis

data agility and quality

Compliance and reporting

Traditional analytical methods often fall short in analyzing the extensive and varied data needed to assess the financial reliability of entities, or to detect evolving fraudulent tactics. This inadequacy can lead to incorrect conclusions, significant financial losses, and reduced customer trust.

Rulex’s native eXplainable AI technology (XAI) allows business users to fully understand predictions from financial data and proactively identify potential bias in the outcome.

High levels of transparency facilitate the implementation of mitigation measures, while guaranteeing compliance with industry and privacy regulations.

- Insurance fraud detection

- Explainable credit rating

- Transaction monitoring

Lending and credit risk

In a dynamic and increasingly regulated market, financial service providers may face challenges in understanding and monitoring all stages of the lending process, from loan origination to early warning signals, and the recovery of non-performing loans.

Rulex Platform positions itself as a powerful decision tool in the hands of bank clerks, simplifying risk management by seamlessly combining industry knowledge with cutting-edge innovation. The Rule Engine task allows for easy and independent integration of business rules into scalable workflows, where AutoML is used in conjunction with XAI to ensure faster turnaround times, fairness, and high levels of accuracy.

- Credit scoring

- Early warning system

- NPL management

- Wealth management

Customer analysis

Gaining clear insights into client preferences involves navigating a competitive landscape, which requires analyzing a multitude of customer data to communicate offers in a timely manner and sustain business growth.

Rulex Platform harnesses a vast array of clustering algorithms to clearly define client profiles. Its eXplainable AI technology and AutoML streamline the analysis of historical data for forecasting potential needs, enabling the implementation of ad-hoc strategies to increase customer loyalty and identify the best target clients for related, supplementary services.

- Client retention

- Cross-selling

- Up-selling

Data agility and quality

While optimal data orchestration and quality are the cornerstones of every successful financial solution, achieving these standards becomes increasingly difficult due to the growing volume of information to manage.

Rulex Platform facilitates the collection, aggregation, and transformation of data from any source and format, including behavioral trends, credit bureau reports, and insights from rating agencies.

Financial institutions can also rely on Rulex’s combo of data quality solutions – data cleansing, rule-based validation, and AI-driven technology – to detect and correct anomalies and discrepancies, thereby ensuring the accuracy and integrity of information.

- AWP machines management

USE CASES

Rulex for the digital transformation of financial services

MANAGE FALSE POSITIVES IN FINANCIAL SERVICES

Banks and financial institutions continually strive to implement strategies that reduce fraudulent activities and the consequent costs. While identifying fraud remains a primary challenge, minimizing false positives is equally crucial.

Rulex and its partner GFT designed an award-winning XAI fraud detection solution, which was fully compliant with GDPR and privacy regulations. Despite the limited examples of fraud, the solution generated reliable predictive rules, resulting in a 10% reduction in false positives and saving the insurance company 50 million euros in claim costs.

INCREASE CUSTOMER RETENTION

Customer churn is a widespread issue that companies face daily. Considering that the cost of acquiring new customers is 6 to 7 times higher than retaining existing ones, an effective customer retention strategy is vital.

Rulex assisted a prominent vendor in accurately identifying possible churners with its XAI technology and comprehending the underlying factors causing it. This allowed the provider to promptly implement effective measures, thereby reducing customer churn by 6%, and boosting revenue by 11%.

IDENTIFY POTENTIAL CREDIT RISKS

Preventing credit risks in a timely manner often requires an in-depth analysis of varied and vast data, which can result in challenges for banks.

Rulex provided a major Italian bank with an ML-based early warning solution for identifying potential risks based on the large amount of data provided.

The solution extracted transaction-driven metrics from data for predictions and implemented business rules to adjust the model’s output when necessary. Thanks to this approach, the bank was able to process around 1 million credit positions every day.

FREE RESOURCES

Free financial services resources

Join the digital transformation